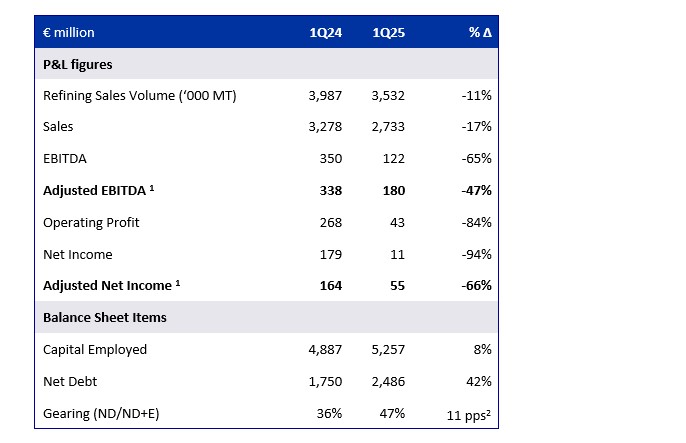

HELLENiQ ENERGY Holdings S.A. ("Company") announced its 1Q25 consolidated financial results, with Adjusted EBITDA amounting to €180m and Adjusted Net Income to €55m.

The results were primarily driven by a weaker refining environment, in addition to reduced oil products sales ahead of the planned full turnaround at the Elefsina refinery which is progressing. The Fuels Marketing business, both in Greece and internationally, recorded improved performance, achieving a record high result for the first quarter. In the Power business, both Elpedison, which remains consolidated under the equity method until the closing of the transaction, and the Renewable Energy Sources (RES) business improved their performance, with a combined EBITDA of €40m.

Refineries’ output in 1Q25 amounted to 3.7m MT, while sales volume reached 3.5m MT (-11% y-o-y), as a result of production and sales planning in order to accommodate the supply of the market during Elefsina’s full turnaround. Despite lower production and increased domestic demand, the share of exports remained at high levels, accounting for 54% of the total sales.

The full turnaround at the Elefsina refinery commenced in late March, is progressing according to schedule and is anticipated to be concluded by mid-June. This represents the most extensive maintenance program since the commencement of operations at the Elefsina refinery, encompassing a broader scope of works, including equipment upgrades following the initial 12 years of operation of the new units and a number of projects both for operational optimization aimed at enhancing refinery performance, as well as for the reduction of carbon footprint by approximately 10,000 tons of CO2.

1Q25 Reported EBITDA amounted to €122m, with Reported Net Income coming in at €11m, primarily due to the impact of the substantial decline in international prices at the beginning of 2Q25 on inventory valuation.

Main developments - Strategy implementation

Upon the completion of the initial phase of the strategic program's implementation, the Group is updating its strategy with an outlook extending to 2030, based on a balanced and pragmatic approach towards energy transition.

In this context, following up on the agreement for the acquisition of the remaining 50% of Elpedison's share capital in December 2024, the relevant share purchase agreement was signed with Edison in April 2025. The completion of the transaction is anticipated within the next two months.

In Refining and Petrochemicals, the Group is implementing initiatives aimed at achieving energy autonomy and enhancing energy efficiency, alongside the expansion of the polypropylene production unit, while maturing carbon footprint improvement projects. At the same time, the Company has upgraded its Supply and Trading operating model by establishing a crude and products trading platform in Geneva, one of the major oil and commodities’ trading hubs worldwide, with the objective of further leveraging its asset base and expanding its international business.

In Marketing, the transformation program is progressing, focusing on the optimization of the retail network in Greece, with the total number of stations down to 1,578, approximately 100 less in the past three years, while increasing company-managed stations, as well as market shares. At the same time, selective expansion in international markets is progressing. Emphasis is placed on the higher contribution of premium products, as well as the sales of products and services other than fuel, while the penetration of the loyalty program is growing.

In the Renewable Energy Sources (RES) business, HELLENiQ Renewables manages a portfolio of a total operational capacity of 494 MW and is developing photovoltaic parks with a cumulative capacity of 211 MW in Romania and 150 MW of battery storage projects in Greece. The total capacity of the project portfolio under development amounts to 5.1 GW within Greece and Southeastern Europe.

Lower crude oil prices and benchmark refining margins – Increased electricity EUA prices

In 1Q25, Brent crude oil declined by 9% y-o-y, averaging $76/bbl. The EUR/USD exchange rate averaged 1.05 vs 1.09 in 1Q24.

On the contrary, natural gas and electricity prices increased by 69% y-o-y and 67% y-o-y respectively, on average, in 1Q25. Accordingly, CO2 prices (EUAs) in 1Q25 recorded an increase of 23% y-o-y, on average.

Refining margins decreased compared with particularly high levels recorded in 1Q24, with our refineries’ system benchmark margin averaging $5.1/bbl vs $8.0/bbl in 1Q24.

Increased demand for fuels in the domestic market

Domestic market demand in 1Q25 reached 1.7m MT, 4% higher y-o-y, with automotive fuels consumption increasing by 2% y-o-y. Demand for aviation fuels grew by 9%, while marine fuel consumption declined by 9%.

Balance sheet and capital expenditure

In 1Q25, operating cash flows were negatively affected, primarily due to the payment of the Solidarity Contribution amounting to €223m, which was imposed on 2023 profits and a temporary increase in working capital requirements due to the full turnaround at the Elefsina refinery. Capital expenditures reached €66m. Consequently, net debt increased to €2.5bn, while excluding non-recourse project finance, it stood at €2.1bn. Nevertheless, the debt service cost declined by 4% y-o-y due to the reduction in base interest rates and spreads. The Group maintains sufficient capacity to support its strategic initiatives and manage market volatility.

Andreas Shiamishis, Group CEO, commented on the results:

“Having completed the first phase of the Vision 2025 strategic transformation plan, we are updating our strategy, based on a pragmatic and balanced transition towards the new energy era. For 1Q25, we reported Adjusted EBITDA of €180m, a satisfactory performance, considering the weak refining environment and the reduced sales resulting from the scheduled full turnaround at the Elefsina refinery. Fuels Marketing performance improved further; it is anticipated that the full consolidation of Elpedison, upon transaction closing, will enhance the contribution from the electricity and RES business, thereby introducing an additional revenue stream to the Group.

The maintenance program at the Elefsina refinery is progressing safely and according to schedule. When operations resume in June, a substantial improvement is expected in the operational performance of the facilities and the environmental footprint.

The transformation program, coupled with ongoing operational improvements, has resulted in a high profitability level. We place particular emphasis on strengthening core refining and trading activities, as well as expanding our international presence in wholesale and fuel stations operations. Vertical integration within the electricity market is anticipated to provide the benefit of a diversified portfolio, encompassing renewable energy sources and natgas-fired units, thereby enabling the realization of synergies and increasing business opportunities.

The key highlights and contribution for each of the main business units in 1Q25 were:

Refining, Supply & Trading

- Refining, Supply & Trading Adjusted EBITDA came in at €134m in 1Q25, lower than the respective period in 2024 due to weaker benchmark margins, tighter crude spreads and reduced sales volume.

- Production amounted to 3.7m MT (-3% y-o-y), with sales volume at 3.5 m MT, 11% lower y-o-y, as, due to the start of the full turnaround at the Elefsina refinery at the end of 1Q25, emphasis was placed on increasing products’ inventory for the smooth supply of the domestic market.

Petrochemicals

- 1Q25 Adjusted EBITDA amounted to €8m, lower y-o-y, due to reduced polypropylene (PP) margins.

Marketing

- In 1Q25, Domestic Marketing’s Adjusted EBITDA improved to €8m due to higher sales volume and increased contribution from the sales of non-fuel products and services, despite the ongoing rationalization in the network (1,578 fuel stations vs 1,623 in 1Q24), alongside the regulatory constraints. Market shares and the contribution from premium products increased for yet another quarter.

- Similarly, International Marketing’s Adjusted EBITDA improved to €17m (+28% y-o-y), driven by network expansion (330 fuel stations vs 323 in 1Q24) and higher margins, with an improved contribution from the sales of non-fuel products and services.

Renewables

- 1Q25 RES EBITDA amounted to €12m. Power generation increased by 8% y-o-y to 173 GWh due to increased installed capacity (494 MW vs 381 MW in 1Q24).

Associate companies

- The contribution of associate companies consolidated using the equity method amounted to €8m, on increased contribution from ELPEDISON.

HELLENiQ ENERGY Holdings S.A.

Key consolidated financial indicators for 1Q 2025

(prepared in accordance with IFRS)